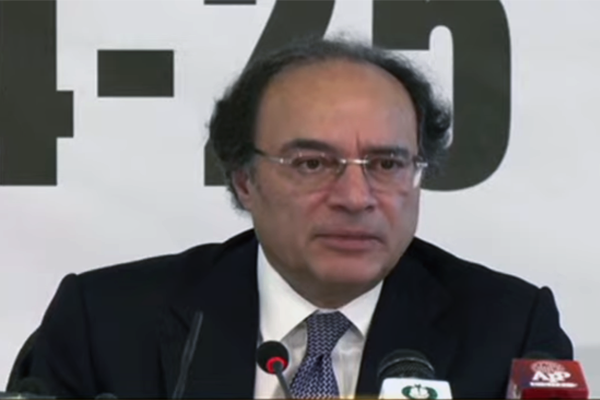

Finance Minister Muhammad Aurangzeb has assured the public that the government will provide relief to the salaried class at the earliest opportunity. “I also come from the salaried class and am one of the top taxpayers. I understand their pain and sympathize with them,” Aurangzeb said, acknowledging the high taxation burden on salaried individuals. “The first opportunity we get, we will provide relief to them,” he reiterated.

The minister emphasized the necessity of making and implementing tough decisions to ensure stable and long-term economic growth. He highlighted recent improvements in the economy, noting that the current account deficit has been reduced, the exchange rate has stabilized, revenue has increased, and foreign exchange reserves have risen to $9 billion. These positive developments have enabled the State Bank of Pakistan to clear all foreign exchange backlogs related to profits, dividends, and Letters of Credit.

Aurangzeb also mentioned the recent approval of $1 billion by the World Bank and $400 million by the International Finance Corporation (IFC). He stressed the importance of continuing these efforts to secure more foreign funding. “We need the IMF programme to bring permanent macroeconomic stability,” he stated, referring to the International Monetary Fund’s support as crucial for endorsing the country’s economic stability and encouraging other donors to provide funds.

The minister highlighted the significance of the IMF programme, which aims to provide $6 billion over three years. This programme is expected to endorse the stability of Pakistan, making it an attractive investment destination for both domestic and foreign investors. “For the IMF programme, we are moving in the right direction and trying to ink the staff-level agreement by this month,” Aurangzeb said. He acknowledged that some structural benchmarks need to be achieved over time, but expressed confidence in reaching the agreement.

One of the key structural reforms includes increasing the tax-to-GDP ratio from 9.5 percent to 13 percent. Energy sector reforms are also part of these benchmarks. Aurangzeb stressed that the IMF programme is essentially Pakistan’s programme, funded and supported by the IMF, and that there is general agreement on the necessity of these structural reforms. He pointed out that Pakistan is spending Rs1 trillion to cover the losses of state-owned enterprises (SEOs), and there is a need to save this amount.

The minister outlined plans to address enforcement and policy gaps through the end-to-end digitization of the Federal Board of Revenue (FBR). By reducing human intervention, revenue leakages will be minimized, leading to increased revenue. The FBR has already shown significant improvement, with a 30 percent year-on-year growth in tax revenue. Aurangzeb emphasized the need for end-to-end decentralization of the FBR to tackle revenue leakage, create transparency, and overcome the trust deficit. He noted that many people avoid the tax net due to a lack of trust in tax authorities, which is unsustainable.

Aurangzeb acknowledged the difficulty of implementing structural reforms and making unpopular decisions, such as removing political appointees from distribution companies and bringing in private sector expertise to improve governance. He highlighted the significant theft in the power sector, amounting to Rs500 billion, which results from the failure to implement structural reforms. He noted that the benchmarks of the previous IMF programmes were similar, but consistent efforts are needed to achieve long-term stability.

The minister underscored the focus on road-to-market strategies, export growth, foreign direct investment (FDI), and access to international capital markets as key initiatives for boosting growth over the next three years. He also mentioned the long-overdue privatization of Pakistan International Airlines (PIA) and the need to clear its debt, which is now parked in other accounts.

Aurangzeb also discussed measures to compel non-filers to enter the tax net. “We have taken the margins provided to non-filers to a punitive level. So those who are non-filers must think multiple times about why they are not coming into the tax net,” he said.

Regarding the IMF programme, the finance minister reiterated its importance for Pakistan’s economic stability. “We need permanence in macroeconomic stability, which is why we seek the IMF programme,” he explained.

On the industry front, Aurangzeb highlighted the government’s initiative to move exporters out of the presumptive tax regime, ensuring that tax is based on income rather than exports. He assured that sales refunds up to June 2024 would be cleared within the next two days to facilitate exporters.

The minister also mentioned the reduction of the Public Sector Development Programme (PSDP) size to Rs250 billion, with a focus on ongoing projects and economically viable new projects. He noted that annual pension expenses amount to Rs1 trillion, and the government plans to shift new civil government employees to a defined contribution scheme as a first step.

Aurangzeb concluded by stressing the need to increase the tax-to-GDP ratio to 13 percent for the country’s survival. He also highlighted ongoing reforms in the power sector and the move towards outsourcing or privatization. Despite the current inflation rate of 12-13 percent and a policy rate of 20.5 percent, he expressed optimism that interest rates could be reduced gradually.