By Mohsin Siddiqui (chief Reporter)

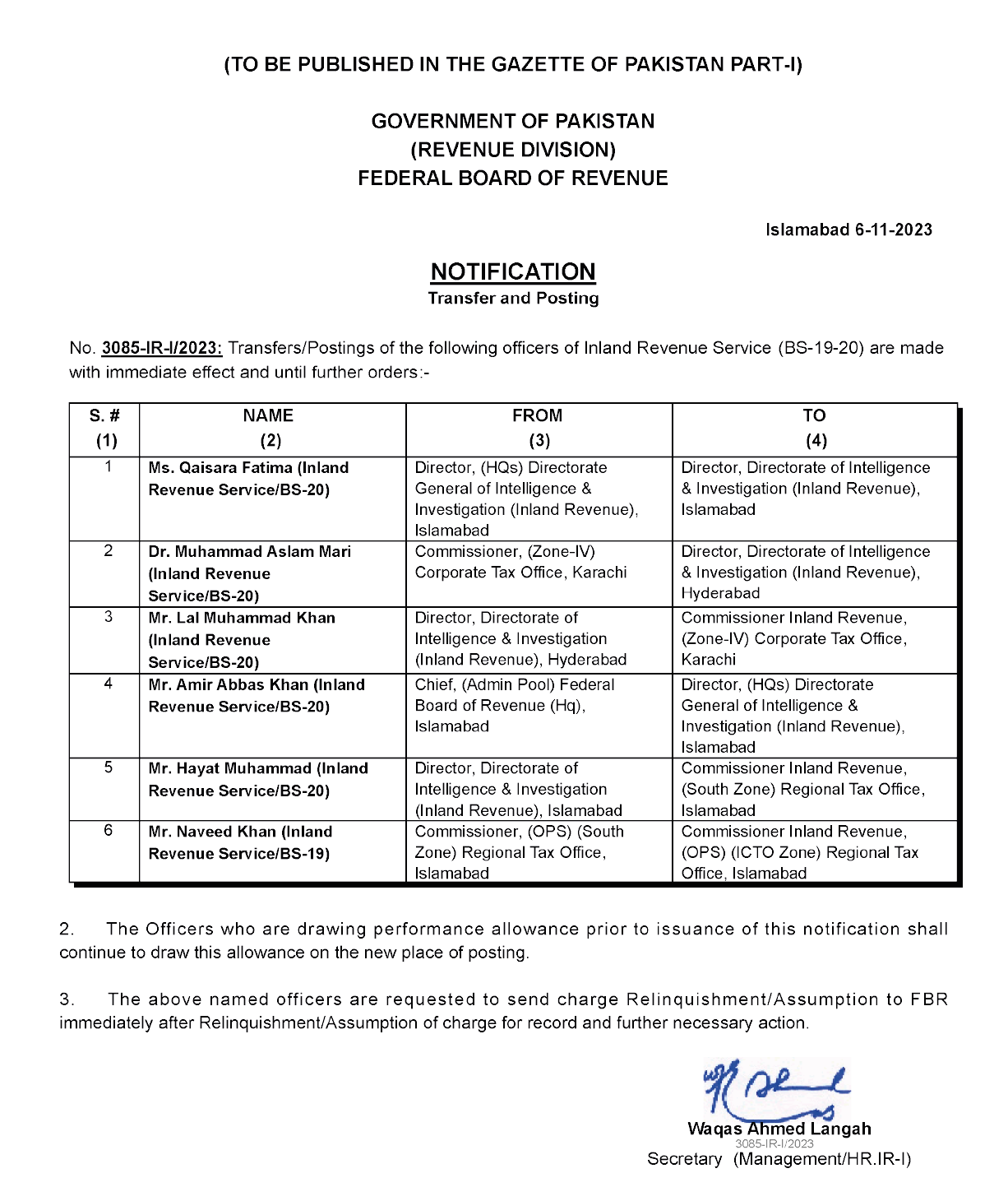

In a recent development within the Federal Board of Revenue (FBR), a significant reshuffle has been announced concerning the transfer and posting of high-ranking officers at the BS-19 and BS-20 levels within the Inland Revenue Service (IRS). This strategic move aims to optimize operational efficiency, leverage expertise, and foster cross-functional collaboration within the service. The immediate transfers/postings of the listed officers within the Inland Revenue Service (BS-19-20) have been implemented, effective immediately, until any subsequent orders are issued.

1. Ms. Qaisara Fatima (Inland Revenue Service/BS-20) from Director, (HQs) Directorate General of Intelligence & Investigation (Inland Revenue), Islamabad to Director, Directorate of Intelligence & Investigation (Inland Revenue), Islamabad.

2. Dr. Muhammad Aslam Mari (Inland Revenue Service/BS-20) from Commissioner, (Zone-IV) Corporate Tax Office, Karachi to Director, Directorate of Intelligence & Investigation (Inland Revenue), Hyderabad.

3. Mr. Lal Muhammad Khan (Inland Revenue Service/BS-20) from Director, Directorate of Intelligence & Investigation (Inland Revenue), Hyderabad to Commissioner Inland Revenue, (Zone-IV) Corporate Tax Office, Karachi.

4. Mr. Amir Abbas Khan (Inland Revenue Service/BS-20) from Chief, (Admin Pool) Federal Board of Revenue (Hq), Islamabad to Director, (HQs) Directorate General of Intelligence & Investigation (Inland Revenue), Islamabad.

5. Mr. Hayat Muhammad (Inland Revenue Service/BS-20) from Director, Directorate of Intelligence & Investigation (Inland Revenue), Islamabad to Commissioner Inland Revenue, (South Zone) Regional Tax Office, Islamabad.

6. Mr. Naveed Khan (Inland Revenue Service/BS-19) from Commissioner, (OPS) (South Zone) Regional Tax Office, Islamabad to Commissioner Inland Revenue, (OPS) (ICTO Zone) Regional Tax Office, Islamabad.

These transfers are expected to invigorate tax administration capabilities, enhance innovative strategies, and ensure effective tax governance.