In a high-profile meeting chaired by caretaker Prime Minister Anwaar ul Haq Kakar, the Federal Board of Revenue (FBR) disclosed its proactive efforts to curb tax leakages and undertake comprehensive digitization of the supply chain involving retailers, wholesalers, and major sector dealers.

During the meeting focused on optimizing FBR’s performance, discussions with the prime minister revolved around expanding the tax net. A new fixed scheme for retailers, accessible through a mobile phone app, was proposed as part of this initiative. The number of return filers has already reached 3.1 million, with projections indicating an increase to 4.9 million. Anticipating an additional 1.5 million return filers this year, the target is set to surpass six million filers by the end of the current fiscal year.

The prime minister received briefings on both the expansion of the tax net and the ongoing digitization efforts within the tax system. Various proposals for the restructuring of the FBR were deliberated upon during the meeting.

Key highlights included the initiation of the task force on tax and FBR reforms. The task force, mandated to review tax policy measures, aims to optimize the tax base, rectify tax gaps, and enhance economic efficiency and equity in the tax system. One of its crucial roles is to identify obstacles in tax collection and propose technology-based solutions.

Responding to these initiatives, the prime minister directed the FBR to present a comprehensive action plan for enhancing its performance and advancing the digitization of the tax system. The meeting also explored the prospect of establishing a separate tax policy division to streamline tax policy formulation and reduce the FBR’s role in this aspect.

In his address, the prime minister emphasized the importance of revenue collection as the backbone of the country’s economy. He underscored the inevitability of utilizing the latest technology for tax system improvement. While acknowledging recent steps to control smuggling, he stressed the need for continued diligence in this regard.

The prime minister urged extensive stakeholder consultations to gather insights for enhancing FBR’s performance. He called for a comprehensive action plan, incorporating suggestions from relevant institutions, to be submitted promptly.

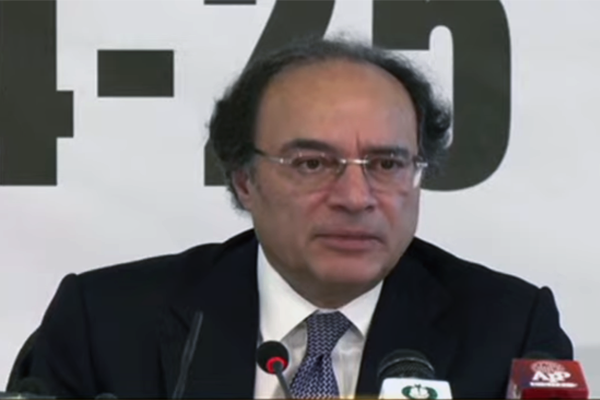

The meeting witnessed the participation of key figures, including Finance Minister Dr Shamshad Akhtar, Advisor to Prime Minister Ahad Cheema, FBR Chairman, Federal Secretary Finance, and other relevant officers.