Mohsin Siddiqui (Chief Reporter)

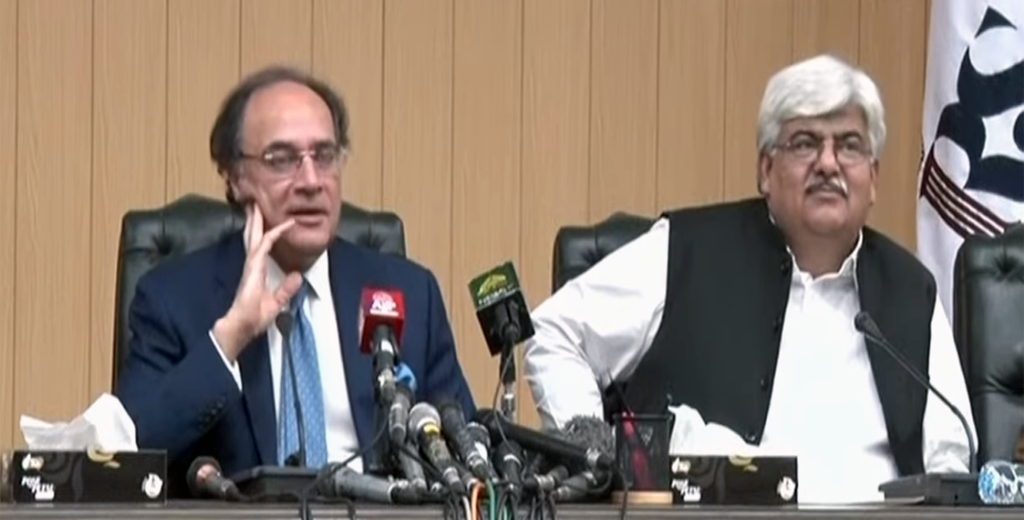

In a press conference held in Islamabad, Pakistan’s Finance Minister, Muhammad Aurangzeb, addressed critical issues regarding the country’s economic stability, focusing particularly on the pressing need to combat sales tax evasion.

His statements highlight the government’s commitment to enhancing revenue collection and enforcing accountability among businesses.

During the conference, Aurangzeb asserted that Pakistan is on the path to economic recovery. He acknowledged the challenges the country has faced but emphasized the positive developments that are emerging. According to him, the Federal Board of Revenue (FBR) is undergoing significant reforms aimed at improving its efficiency and effectiveness in tax collection. “We are implementing measures to enhance the performance of the FBR,” he said, adding that these reforms are essential for establishing a more robust economic foundation.

The Finance Minister outlined that Pakistan’s current account deficit is on the decline, which he views as a positive indicator of economic health. Interest rates are also decreasing, signaling potential relief for borrowers and consumers. The government aims to elevate the Gross Domestic Product (GDP) growth rate to 13 percent, demonstrating a clear focus on economic growth and development.

One of the most critical points raised by Aurangzeb was the rampant issue of sales tax evasion among various sectors. He expressed his frustration over companies manipulating input taxes to reduce their tax liabilities, a practice that undermines the integrity of the tax system. “When companies fail to remit collected sales tax, they break the trust that is essential for our economic system,” he stated firmly.

To address this issue, the government is not only focusing on reforming the tax system but is also introducing specific measures within the energy sector to mitigate tax leakage. Aurangzeb emphasized that the government cannot tolerate dishonesty from companies, asserting that the evasion of taxes leads to substantial losses for the economy.

The Finance Minister disclosed alarming figures related to tax evasion in various industries. He pointed out that companies in the steel sector alone are evading taxes amounting to approximately 29 billion rupees. This revelation underscores the significant financial impact that such evasion has on the national treasury and, ultimately, on public services and infrastructure.

In addition to the steel industry, the cement sector is reportedly involved in 18 billion rupees of sales tax evasion related to coal. The textile industry, another crucial sector in Pakistan’s economy, is evading taxes amounting to 23 billion rupees. These statistics highlight a widespread issue that the government is determined to confront.

Aurangzeb also noted that the battery manufacturing sector is implicated in 11 billion rupees of tax evasion, while the beverage industry accounts for an additional 15 billion rupees. Altogether, he estimated that a staggering total of 128 billion rupees is being evaded across various sectors, which represents a significant loss of potential revenue for the government.

The Finance Minister did not shy away from discussing the legal ramifications of tax evasion. He made it clear that the law is stringent, stating that evading one billion rupees in tax can lead to a penalty of up to five years in prison. This firm stance is intended to deter businesses from engaging in fraudulent activities and to promote a culture of compliance.

At the conference, FBR Chairman Rashid Langrial echoed the Finance Minister’s concerns, stating that many companies resort to dishonesty to evade sales tax. He issued a stern warning to CEOs, advising them against signing sales tax returns that may contain inaccuracies or omissions. Langrial made it clear that there would be no tolerance for tax evasion, and individuals caught in such practices would face legal consequences, including potential arrests.