PTBP Web Desk

Pakistan’s Finance Minister, Mohammad Aurangzeb, highlighted the critical need for structural reforms in order to reshape the country’s economic “DNA” and reduce reliance on future aid from the International Monetary Fund (IMF).

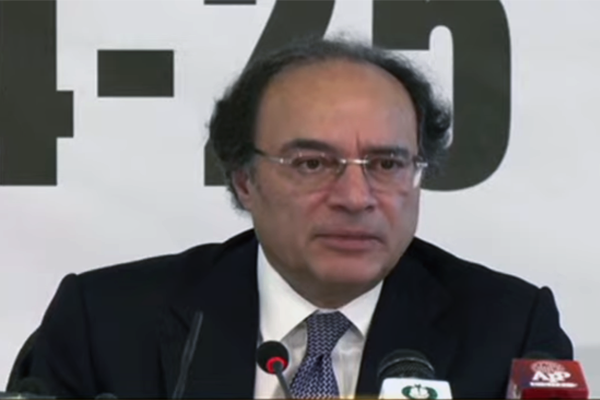

Addressing the media during a press conference, Aurangzeb emphasized that these reforms, while challenging in the short term, are essential for the country’s long-term economic sustainability. Aurangzeb also announced a forthcoming ‘National Fiscal Pact’ to be signed between the federal government and all four provincial administrations. This pact is aimed at unifying provincial taxes, particularly targeting the agriculture sector, to increase revenue collection. The agreement is expected to align the taxation policies of the provinces with federal regulations and ensure growth in provincial revenues. The Finance Minister thanked provincial chief ministers for their cooperation in moving toward these fiscal reforms.

Aurangzeb explained that the National Fiscal Pact, developed in collaboration with the provincial governments, will be a major step forward in reforming Pakistan’s taxation system. The pact will introduce uniform tax measures across provinces, particularly focusing on imposing taxes on the agriculture sector, which has historically remained untaxed. This measure is aimed at increasing provincial revenue and contributing to the federal budget.

In addition to reforms in taxation, the pact will also emphasize cutting down on both federal and provincial expenditures. Aurangzeb assured the public that efforts to increase transparency in governance are central to the government’s overall fiscal strategy. A committee has been established to “right-size” the federal government by reviewing various ministries and their functions. As part of this initiative, six ministries will be affected, including the dissolution of the Ministry of Capital Administration and Development (CAD) and the merging of two other ministries.

Aurangzeb revealed that 60% of the 150,000 vacant government positions have already been eliminated as part of an expenditure reduction strategy. This move is expected to result in significant savings for the government. He assured the public that these are not just empty promises, stating, “We are taking practical steps toward implementation.” The restructuring of five additional ministries will be finalized during the current fiscal year, as part of the broader plan to streamline the government in accordance with the 18th Constitutional Amendment.

In addition to reducing government expenditure, the Finance Minister announced that the Federal Board of Revenue (FBR) will be hiring 2,000 chartered accountants to enhance the auditing capabilities of the tax collection system. This is part of the government’s initiative to address the issue of under-filing, which currently hides nearly Rs1.3 trillion in unpaid taxes. He emphasized that improving tax audits is key to boosting revenue collection and reducing tax evasion.

Aurangzeb noted that the government is tackling the challenges posed by tax evasion, including under-filing and non-compliance. To further address this, the government is introducing stricter penalties for non-filers. These penalties include barring non-filers from purchasing property or vehicles and prohibiting them from opening current bank accounts.

Expanding the tax base is another critical objective for the government. Aurangzeb stated that only 14% of manufacturers and 25% of wholesalers are currently registered for sales tax, which he described as “unacceptable.” The government plans to take strict action against non-compliant businesses, including property seizures, utility disconnections, and the blocking of mobile services.

He added that the government will utilize technology to minimize direct contact between businesses and tax authorities, thereby improving transparency in tax collection and reducing the potential for corruption.

The Finance Minister provided an update on Pakistan’s macroeconomic stability, achieved through the recent nine-month Stand-By Agreement (SBA) with the IMF. Aurangzeb confirmed that the IMF board had approved a 37-month, $7 billion Extended Fund Facility (EFF) for Pakistan, and the first tranche of funds had already been received.

He also highlighted the importance of structural reforms in maintaining macroeconomic stability, stressing that the government is committed to ensuring these reforms are implemented. Aurangzeb announced that inflation, once as high as 38%, has now decreased to single-digit figures, and the policy rate has been lowered accordingly. He also noted improvements in foreign exchange reserves and a 29% year-on-year increase in IT exports.

Despite these improvements, Aurangzeb reiterated the government’s commitment to reforming state-owned enterprises (SOEs) and ministries to ensure they function efficiently and transparently. He emphasized that ministries and institutions that do not contribute to public service will be restructured or dissolved.

Aurangzeb addressed the ongoing issue of smuggling, which significantly impacts tax revenues, costing the country Rs750 billion annually. The government is establishing digital checkpoints at major border crossings to curb illicit trade and boost compliance.

Additionally, Aurangzeb stressed the need for greater transparency in economic activities. The cash market in Pakistan is currently valued at Rs9 trillion, but only Rs325 billion is documented. The government aims to increase the level of documented economic activity, with long-term goals of improving the tax-to-GDP ratio and eventually joining the Group of 20 (G20).

Aurangzeb mentioned that 723,000 new taxpayers had registered this year, bringing the total number of registered taxpayers to 3.2 million, up from 1.6 million last year. He reiterated that non-filers would no longer be allowed to purchase property or vehicles, as part of the government’s push to increase tax compliance.

Aurangzeb acknowledged the challenges posed by Pakistan’s high population growth rate of 2.5% and the growing impact of climate change on the economy. He stressed the importance of addressing these issues alongside economic reforms, with the ultimate goal of ensuring that this IMF loan program will be the last one Pakistan requires.