Fitch Ratings has upgraded Pakistan’s Long-Term Foreign-Currency Issuer Default Rating (IDR) from ‘CCC’ to ‘CCC+’. This upgrade reflects a positive shift in the country’s economic outlook, influenced largely by recent developments in its external funding situation and economic reforms. The upgrade announcement was made by Fitch on Monday, signaling increased confidence in Pakistan’s financial stability and its ability to secure further funding.

The upgrade by Fitch is primarily attributed to Pakistan’s recent staff-level agreement (SLA) with the International Monetary Fund (IMF) for a new 37-month Extended Fund Facility (EFF) worth USD 7 billion. This agreement is a pivotal factor in the improved rating, as it demonstrates greater certainty regarding the availability of external funding for Pakistan. Fitch’s statement highlights that the positive performance under the previous IMF arrangement has significantly contributed to narrowing fiscal deficits and rebuilding foreign exchange (FX) reserves.

Fitch acknowledged the strong performance on the prior, more temporary IMF arrangement, which helped Pakistan stabilize its fiscal situation and enhance its FX reserves. This positive trajectory is expected to continue, assuming the country successfully implements further reforms. However, Fitch also warned that Pakistan’s large funding needs pose a risk if necessary reforms are not executed effectively, which could jeopardize program performance and continued funding.

Fitch anticipates that the IMF Board will approve the new $7 billion EFF programme for Pakistan by the end of August. Before this approval, the government is required to secure new funding assurances from key bilateral partners, including Saudi Arabia, the United Arab Emirates (UAE), and China. These assurances are expected to total approximately $4-5 billion over the duration of the EFF. Fitch believes that this target is achievable, given the strong historical support from these countries and the significant policy measures included in Pakistan’s recent budget for the fiscal year ending June 2025 (FY25).

Reflecting on Pakistan’s performance under the previous IMF program, Fitch noted that the country successfully completed its nine-month Stand-by Arrangement (SBA) with the IMF in April. During this period, the government implemented a series of measures including raising taxes, cutting public spending, and increasing prices of essential commodities such as electricity, gas, and petrol. Additionally, significant efforts were made to narrow the gap between the interbank and parallel market exchange rates through regulatory measures and a crackdown on the black market.

Fitch provided insights into key macroeconomic indicators, forecasting a relatively contained current account deficit (CAD) of about $4 billion (approximately 1% of GDP) for FY25. This is a substantial improvement from the $700 million CAD recorded in FY24. The sharp reduction from over $17 billion CAD in FY22 is attributed to contractionary economic and fiscal policies, lower commodity prices, and a depreciating rupee. Additionally, FX shortages have eased with the return of remittances to the official banking system.

Regarding external debt, Fitch highlighted that Pakistan faces over $22 billion in external public debt maturities in FY25. This includes $13 billion in bilateral deposits and loans, nearly $4 billion in State Bank of Pakistan (SBP) liabilities, and similar amounts from Chinese commercial banks and multilateral creditors.

Fitch observed that while Pakistan’s foreign exchange reserves have recovered, they remain low. The SBP’s official gross reserves, including gold, rose to over $15 billion by June 2024, up from nearly $10 billion at the end of June 2023. The reserves are expected to approach $22 billion by the end of FY26, nearing their 2021 peak. The SBP’s net liquid FX reserves, excluding gold and FX reserve deposits of banks, also recovered to over $9 billion by June 2024.

On the fiscal front, Fitch noted that the FY25 budget includes significant revenue measures under the EFF framework. The budget projects a headline deficit of 5.9% of GDP and a primary surplus of 2.0%, compared to the FY24 estimates of 7.4% and 0.4%, respectively. Fitch’s forecast assumes partial implementation of these measures, projecting a primary surplus of 0.8% of GDP and an overall fiscal deficit of 6.9% in FY25, improving to 1.3% of GDP and 6% of GDP by FY26. The budget also includes plans to double SBP dividends to 2% of GDP and provincial surpluses to 1% of GDP.

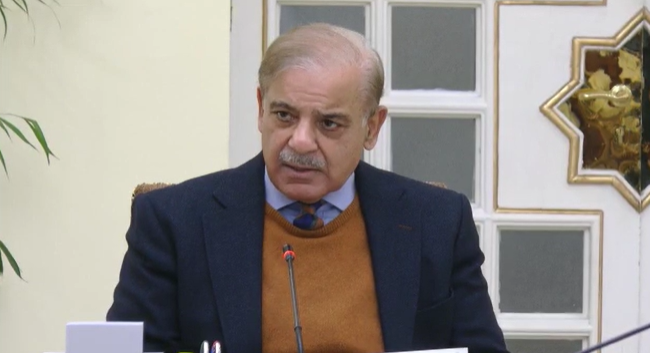

Fitch’s report also touched on the political situation in Pakistan, noting that the narrow outcome of the February elections resulted in a weaker-than-expected mandate for Prime Minister Shehbaz Sharif’s PML-N party. Despite having a slim majority in the National Assembly, the party faces challenges following a recent Supreme Court ruling that re-allocated reserved seats in favor of independents linked with former Prime Minister Imran Khan’s PTI party. Khan, currently imprisoned since May 2023, remains a popular figure, adding to the political dynamics.