Mohsin Siddiqui (Chief Reporter)

In January 2024, foreign portfolio investors initiated significant selling activities at the Pakistan Stock Exchange (PSX), amounting to $35 million, marking the highest net selling in 12 months, reports Topline Securities, a prominent brokerage house.

The surge in selling has raised concerns among investors, particularly amidst anticipation of a pre-election rally in the market. Topline Securities indicates that leading global ETFs, notably Global X ETFs, have been prominent sellers, with the New York-based provider announcing the liquidation of 19 ETFs, including the Pakistan ETF.

By the end of December 2023, the Pakistan ETF held an investment of $33.23 million, which has since decreased to $2.3 million as of January 30, 2024. This reduction in ETF size has been a significant contributor to foreign corporate selling observed at the PSX in recent weeks.

Despite the selling pressure, there has been renewed interest from foreign portfolio investors following Pakistan’s successful negotiation of a $3-billion Stand-By Agreement (SBA) with the International Monetary Fund (IMF) in June of the previous year.

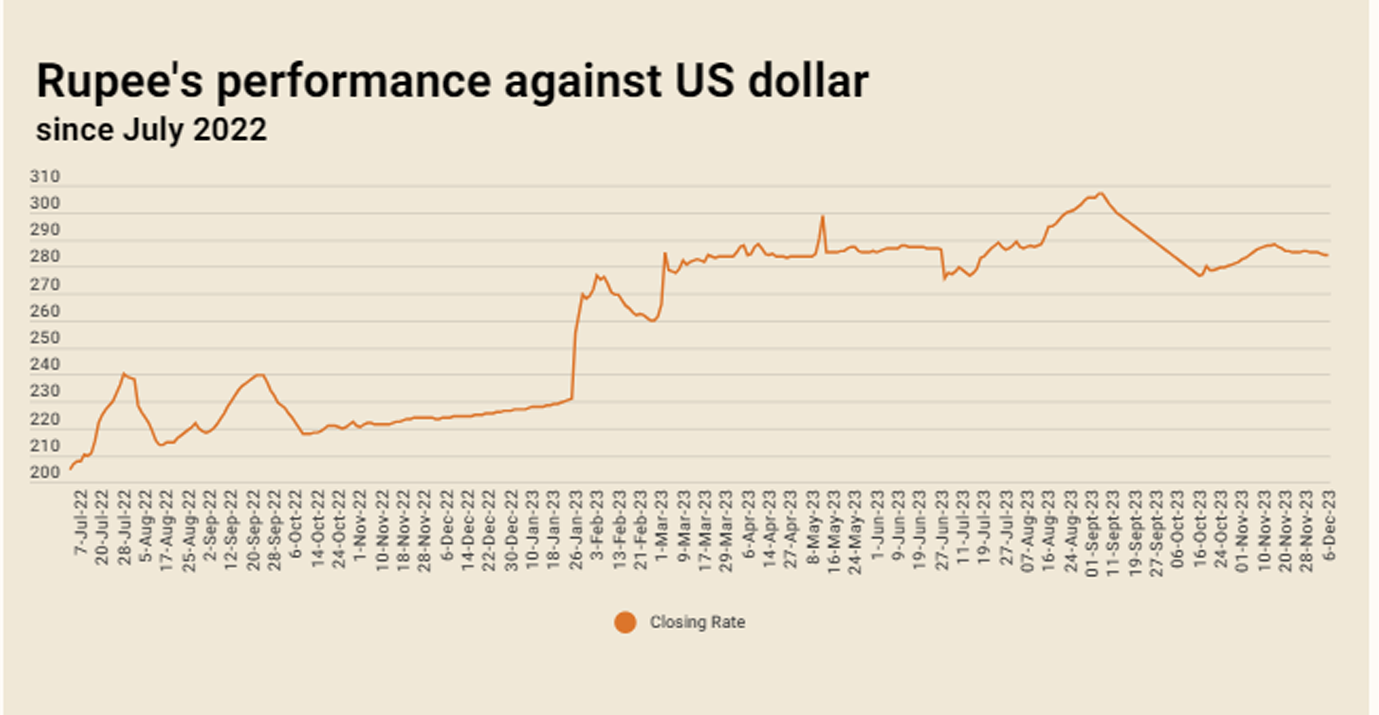

Topline Securities notes that from July to December 2023, foreign corporates bought shares worth $239 million and sold $164 million at the PSX, resulting in a net buying of $75 million, marking the highest inflow in eight years. Factors contributing to this inflow include the IMF loan, stability in the Pakistani Rupee (PKR), and stringent measures implemented by the caretaker government.

In summary, while foreign selling has dominated the PSX in January 2024, recent developments such as the IMF agreement and government measures offer potential for market stabilization and renewed investor confidence.