IMF denies requesting a reduction in tax slabs for the salaried and business class from seven to four, which would potentially impact the middle and upper-middle income groups.

Additionally, there is no indication of an impending increase in the maximum petroleum development levy. “There are no plans at this time,” clarified Ruiz in response to the media speculations.

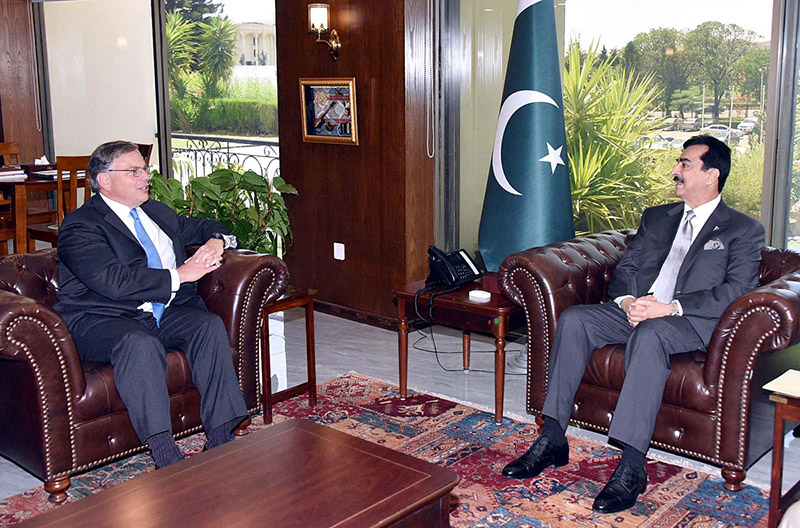

It’s essential to note that Pakistan is currently operating under a caretaker government following the approval of an IMF loan program in July. The $3 billion standby arrangement (SBA) aimed to avert a sovereign debt default, with Pakistan receiving $1.2 billion as the first tranche in July.

The country faced a severe balance of payment crisis before the IMF intervention, with foreign exchange reserves barely covering three weeks of controlled imports. The economic challenges included historically high inflation and unprecedented currency devaluation.

As part of the bailout deal, the IMF required Pakistan to generate $1.34 billion in new taxation to address fiscal adjustments. However, these measures contributed to an all-time high inflation rate of 38% year-on-year in May, making it the highest in Asia. Despite efforts, inflation remains above 30%.