The country’s economy is in serious trouble, and its people are suffering. The main culprit is the power sector, including its handlers and policymakers.

The country’s ruling elite devised a plan to install thermal power plants as part of short-term policies. Consequently, these plants were installed, and deals were made.

These power plants are known as Independent Power Plants (IPPs), which are extracting money from legal consumers while those involved in power theft benefit without consequence.

These IPPs were established during various regimes of previous governments. There is now talk that faulty agreements were managed with IPPs to benefit them, resulting in widespread suffering due to these agreements.

Despite several IPP owners investing in rupee terms, these plants were allowed dollar indexation. Additionally, IPPs were permitted to charge capacity payments. As a result, non-operational power plants are charging over Rs 2.2 trillion annually for capacity payments from electricity consumers.

The story does not end here.

Previous governments also granted these power plants tax exemptions worth trillions of rupees under various policies.

According to the Auditor General of Pakistan, the government granted tax exemptions to Independent Power Producers (IPPs) totaling Rs 167.896 billion from FY 2018 to FY 2022. This benefit was extended to 220 taxpayers assessed as IPPs.

Thus, IPPs not only earned money through capacity payments but also through tax exemptions.

Authors of Power Policies

Several key factors have contributed to the miseries of consumers and governments:

Setting Up Independent Power Plants (IPPs): These IPPs were given higher returns and uncapped dollar indexation. Additionally, policies were introduced to run these plants on oil linked with capacity payments.

Power Policy 1994

This policy, introduced during the Pakistan Peoples Party (PPP) regime, was the first to set up IPPs. It aimed to attract foreign investment for large-scale power generation projects. While it boosted installed capacity, power tariffs increased due to higher tariff costs. Imported fuel plants meant fluctuations in global oil prices impacted domestic electricity tariffs.

Power Policy 1998

Following the controversies of the 1994 policy, PML-N introduced the 1998 Power Policy. This policy introduced competitive bidding for projects based on pre-determined tariffs, leading to more competitive pricing and lower investor returns compared to the 1994 policy.

Power Policy 2002

Under Pervez Musharraf’s regime, the 2002 Power Policy was introduced to address high electricity tariffs and promote renewable energy. It introduced “fuel price indexing” to reduce tariff uncertainty for IPPs and offered incentives for renewable energy projects. However, the policy did not achieve its objectives significantly.

Power Policy 2015

With PML-N back in power, the 2015 Power Policy aimed to attract investment for IPPs under CPEC. It sought to bridge the demand-supply gap and included an “upfront tariff” mechanism based on competitive bidding with pre-determined caps. Several projects, including coal-based ones, were set up under CPEC with high return rates up to 30 percent. The PTI government revised tariffs for IPPs under all policies except 2015 due to the difficulty of negotiating revised deals with CPEC IPPs.

Payments to IPPs

Currently, the cost of energy is Rs 9.15 per unit for consumers. However, the government is paying Rs 18 per unit for non-operational power plants, showing that idle plants are rewarded more than operational ones. Consumers are paying 70 percent of the total electricity cost for capacity payments. This means if the electricity cost is Rs 100, Rs 70 goes to non-operational plants, and Rs 30 goes to operational ones.

Consumers are also paying over 50 percent in taxes on the total cost of electricity generation, including excise duty, general sales tax (GST), GST on fuel price adjustment (FPA), excise duty on FPA, and fuel cost surcharge. Additional taxes include electricity duty, income tax, advance income tax, and further tax.

According to power division officials, consumers pay Rs 2.2 trillion to Rs 2.8 trillion annually in capacity payments to IPPs.

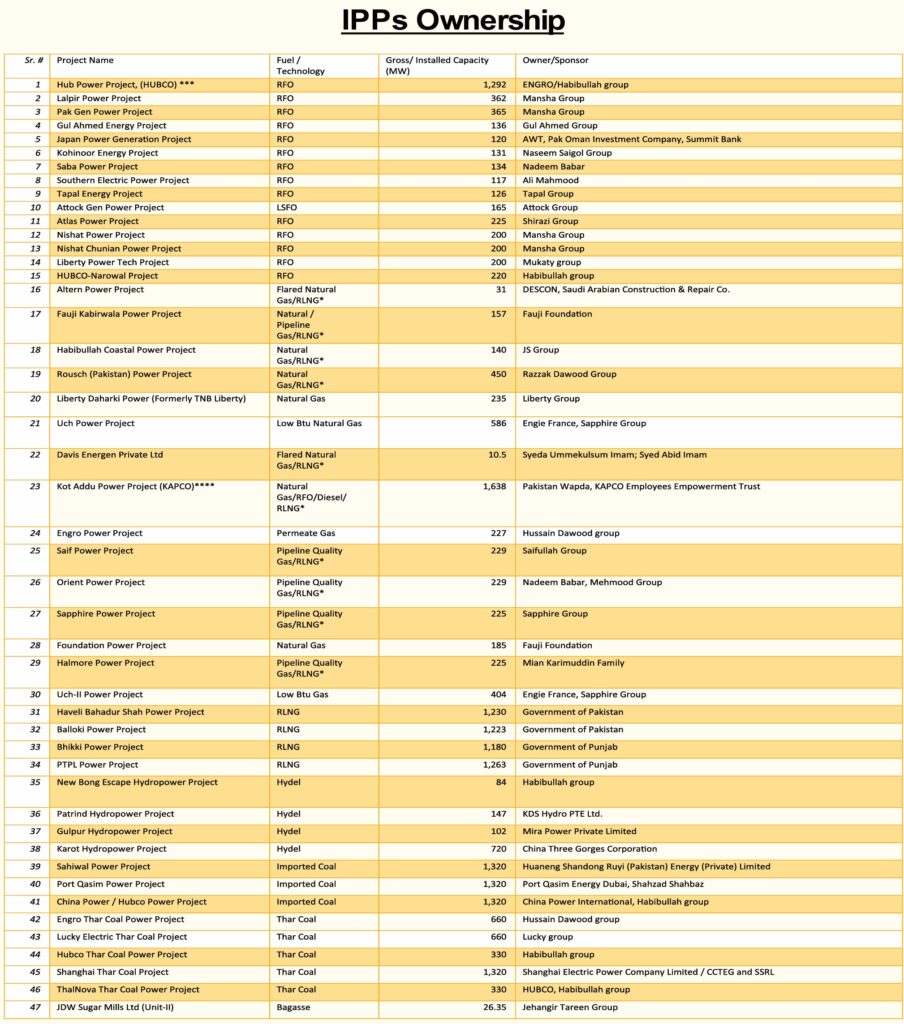

Who Owns IPPs?

Political party associates run many IPPs, which makes the Shahbaz-led government reluctant to take action against them. Due to high electricity costs, many businesses have shut down or shifted to solar resources. In response, the government launched a campaign against net metering for solar, fearing a loss of consumers in the national grid to pay capacity payments.

CPEC Plants

Prime Minister Shahbaz Sharif has formed a Task Force, chaired by the power division minister, to strategize negotiations with IPPs to cut capacity payments. The government plans to shut down old power plants and privatize power distribution companies (Discos). However, CPEC plants are considered “holy cows,” and there is no intention to renegotiate deals with Chinese companies. Instead, the government plans debt reprofiling with Chinese power plants, seeking to rollover debt rather than renegotiate terms.

The power plants set up under the 1994 policy were granted an 18 percent rate of return, and corruption cases were filed against then-President Asif Ali Zardari. However, CPEC plants received a 33 percent rate of return, reflecting the disparity in treatment.

Inquiry Report Shows alarming profits of IPPs

Muhammad Ali, recently appointed advisor to the Prime Minister on Power and former head of the Inquiry Committee on IPPs during the PTI tenure, has highlighted shocking findings. Despite this, no action was taken against IPPs, and amended agreements were signed.

As co-chairman of the Task Force formed by Prime Minister Shahbaz Sharif, he asserts that the findings required immediate action.

The report shows that under Power Policy 1994, 16 out of 17 projects invested a combined capital of Rs 51.80 billion and earned profits exceeding Rs 415 billion, with dividends of Rs 310 billion. Profit was up to 18.5 times, and dividends up to 22 times. Six projects earned an average return of 60-79 percent, while four earned 40 percent.

The report reveals that 13 residual fuel oil and gas-based power plants established under Power Policy 2002 earned Rs 203 billion in profit against a combined investment of Rs 57.81 billion. After debt adjustment, they earned Rs 152 billion profit and paid out Rs 111 billion in dividends. Some plants achieved an average return of 87 percent.

Two imported coal-based power plants under Power Policy 2015 recovered 71 percent and 32 percent of their investment within two and one years, respectively. These plants received a 17 percent return in USD, translating to a 27 percent return due to rupee depreciation.

Excess setup costs of Rs 32.46 billion were allowed due to misrepresentation by sponsors. The Sahiwal Coal Power Plant alone is entitled to an excess annual return of USD 27.30 million, totaling Rs 291.04 billion over the project’s 30-year life.

Eight bagasse-based plants under the 2013 Framework for Co-Generation, with a total capacity of 254 MW, were paid excessively due to overestimation of Net Annual Plant Capacity (NAPC). This resulted in excess payments of Rs 6.33 billion.

The current government should review this report again and resume inquiries into IPPs based on these findings. Otherwise, IPPs will continue to drain the country’s resources and exploit poor electricity consumers.