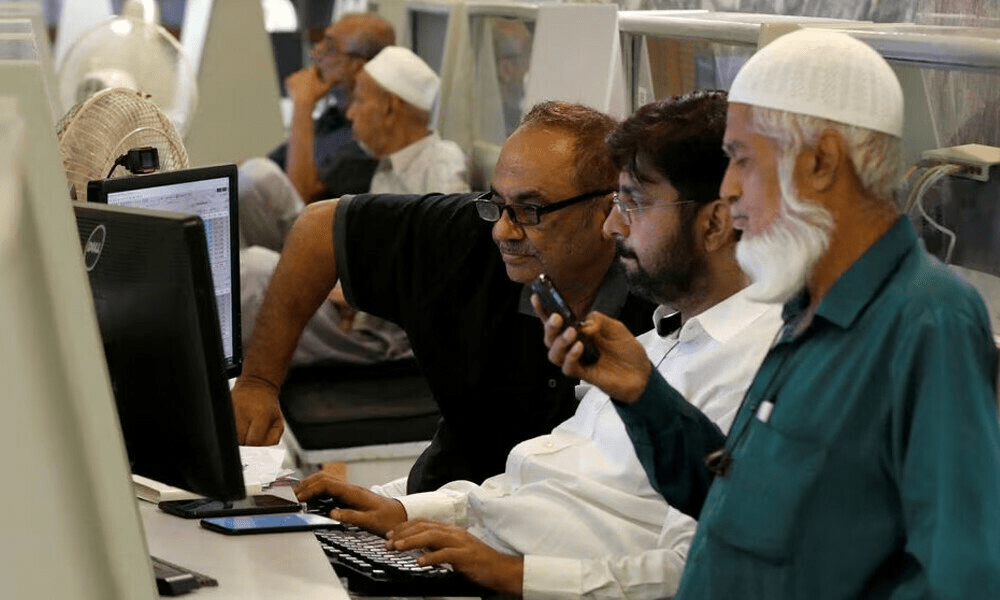

The benchmark KSE-100 index witnessed a significant decline, shedding nearly 1,200 points during Thursday’s trading session due to extensive selling, particularly in the energy sector stocks. By 3:05 pm, the index stood at 60,966.10, marking a decrease of 1.91%, with index-heavy stocks like OGDC, PPL, and PSO experiencing substantial losses.

Market experts attribute this downturn to escalating political volatility, which is increasingly impacting the country’s economic outlook and investor sentiments.

In a recent report, Moody’s Investors Services highlighted the credit negative impact of political uncertainty in Pakistan following inconclusive election results. The uncertainty surrounding Pakistan’s ability to negotiate a new IMF program post-April 2024 adds further strain on the economic landscape.

On the corporate front, PSO reported significant consolidated losses amounting to Rs10.43 billion in the second quarter of fiscal year 2023-2024, primarily due to escalating operating and financial expenses.

In political developments, the Azad Jammu & Kashmir Election Commission issued an arrest warrant for Pakistan Tehreek-e-Insaf (PTI) leader Ali Amin Gandapur, who has been nominated for the chief minister position in Khyber-Pakhtunkhwa.

Meanwhile, globally, Asian stocks surged, with the Nikkei hitting a new 34-year peak, while European markets opened positively despite the UK economy entering a recession.

Note: The rewrite aims to maintain the essence of the original news while optimizing it for SEO and readability.