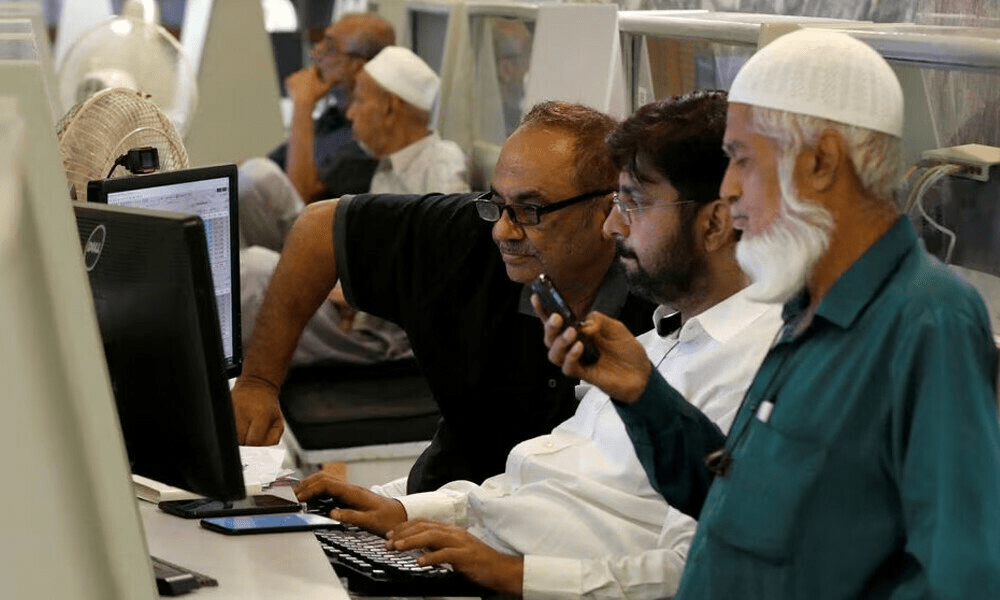

Pakistan Stock Exchange (PSX), the benchmark KSE-100 index witnessed a steep decline of over 900 points during Tuesday’s trading session. At 12:30 pm, the benchmark index stood at 64,827.64, marking a decrease of 927.66 points or 1.41%. Notably, a broad-based selling trend was observed, impacting key index-heavy stocks such as OGDC, PPL, PSO, and SHEL, all trading in the red.

In a significant development, Muhammad Aurangzeb, former Chief Executive Officer (CEO) of HBL, assumed the role of Finance Minister of Pakistan after being officially sworn in at the Presidency, according to a statement from the Ministry of Finance released on Monday. This appointment follows intense speculation regarding the selection of the finance minister, with Aurangzeb chosen over several experienced candidates, including four-time finance minister Ishaq Dar. Aurangzeb’s tenure comes at a critical juncture for Pakistan’s economy, grappling with challenges like rising debt, low growth, and high inflation.

Investors, anticipating this appointment, were keen on the selection of the new Finance Minister, recognizing the pivotal role in negotiations with the International Monetary Fund (IMF), as highlighted by Topline Securities in its report. The brokerage house expressed confidence in Aurangzeb’s extensive experience in the financial sector, coupled with Musaddik Malik’s oversight of the energy sector, as conducive to addressing Pakistan’s economic challenges.

On the stock market front, despite a positive start, the PSX experienced selling pressure on Monday, resulting in the benchmark KSE-100 closing the trading session in the red at 65,755.31, down by 38.45 points or 0.06%.

Internationally, Asian stocks showed mixed trends, with Japanese shares declining while Asian-Pacific shares outside Japan slightly rose ahead of the US inflation report. Additionally, gold hovered close to its record peak, and the dollar remained stable as traders awaited the US consumer price index report to gauge the Federal Reserve’s potential rate-cutting cycle.