China again came to rescue Pakistan by reprofiling its soaring debt and enable Pakistani authorities to reach staff level agreement with IMF for another loan program. Experts believed that the Chinese loans not only deepening the debt trap but may also force the Government to give undue favors to China, which further aggravate the political unrest.

Prevailing political instability, fragile law and order situation and most importantly lack of coordination among state institutions put country on the verge of default. The only country in last decade or so invested heavily in Pakistan is China. Through CPEC it invested $46 billion in last one decade and planned further investment of almost $20 billion.

However despite such a huge investment Pakistan’s economy unable to boost itself because of poor planning and civil-military tussle over the ownership of this project which led to the downfall of Nawaz Sharif led Government. The wrangling among state institutions and judicial activism shattered investors’ confidence and led to huge capital outflow from the country. As a result, Pakistan every now and then look at friendly countries like China, Saudi Arabia and UAE to rescue them from default. Out of State Bank foreign exchange reserves of $9.4 billion, more than $5 billion are the deposits of China, Saudi Arabia and UAE. Unlike zero interest rate on the previous loans, this time all of these three countries charging market based mark-up rate from the Government.

Finance Minister Muhammad Aurangzeb already confirmed commitments from China, Saudi Arabia and the United Arab Emirates to rollover debt for a year, so Pakistan can secure its next bailout with the International Monetary Fund (IMF).

The development comes as Pakistan seeks re-profiling of debt from China as well ahead of the Executive Board meeting of the IMF. Last month, Pakistan authorities and the IMF reached a staff level agreement for a $7-billion, 37-month loan program aimed at cementing stability and inclusive growth.

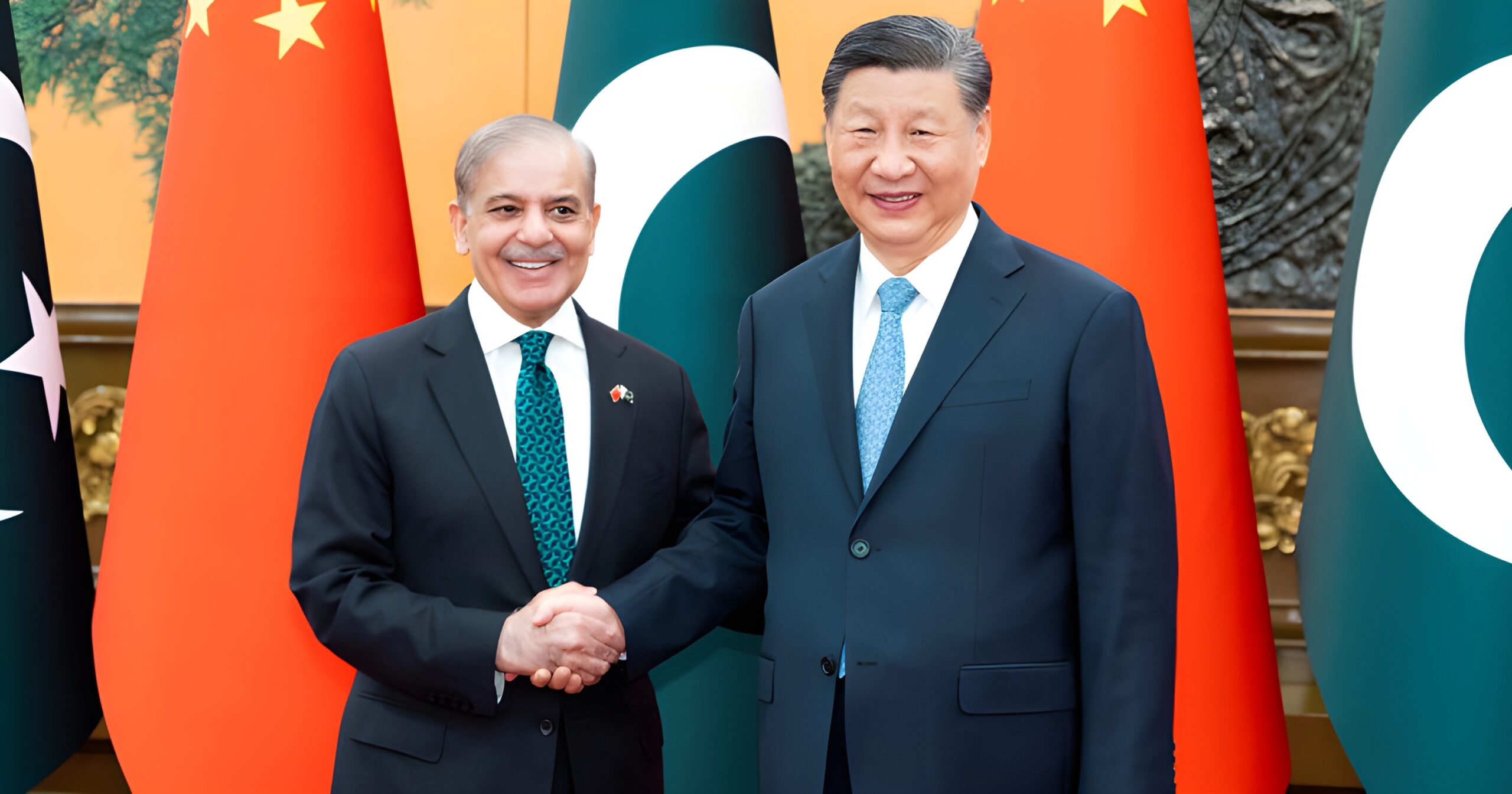

This is on top of Islamabad’s request to Beijing to convert imported coal-based projects to local coal and reprofile more than $15bn in energy sector liabilities to create fiscal space amid difficulties in timely repayments. Earlier in an address to the Parliament, Prime Minister Shehbaz Sharif apprised that he had written a letter to China, “it’s a matter of public domain now, for [debt] reprofiling.” Prior to this, Finance Minister and Energy Minister Awais Leghari also visited China with a request to reprofile energy debt.

According to the World Bank, debt reprofiling refers to “modifications of the aggregate schedule of future country repayments through refinancing, debt substitution, or renegotiations.”

The process can help a country if it’s facing simultaneous maturity of multiple loans or experiencing exposure issues, such as in the currency composition of its liabilities. It can also help a country mitigate currency risk, which frequently exacerbates debt sustainability issues.

According to finance minister said that there would be nine Chinese IPPs, including one transmission line, and they could not go ahead with knee-jerk approach. He said that the joint working groups would be established to create a win-win situation for both the sides. It would be long process for discussing with individual IPPs the issue of their rate on equity and dividend in detail, he added.

The minister also confirmed that Pakistan was discussing $600 million commercial loan from Chinese banks. He said that Pakistan would launch the Panda Bond whereby they intend to register $1 billion out of which $150 to $200 million would be capitalised in the first phase.

Contrary to Government claims, the economists believed that the full servicing of obligations to IPPs looks increasingly unlikely. The issues include currency mismatch (earnings of IPPs denominated in dollars while revenues of the system are in rupees), negotiated rates on generous terms (e.g. committed returns of 15% in dollar terms and income tax exemptions for the entire period of the contract), and sovereign guarantees covering even market risk.

The so-called ‘circular debt’ is the outcome of these structural issues that have made the economy uncompetitive and hence a huge constraint to growth and its sustainability. The situation has been worsened by poor policy design and ‘other considerations’ resulting in installed generation capacity today being close to 44000 MW, against the demand of 23000 MW, partly also owing to inadequate carrying capability of the transmission infrastructure and distribution systems. This has given rise to a requirement of Rs. 2 trillion in 2023-24 for capacity payments of which Rs. 1.3 trillion will just be for the plants lying idle; with the share of capacity payment in the base tariff per unit now Rs. 24 billion (including all entities generating energy- thermal, solar, wind, nuclear, government owned, etc.)

Though during the PTI Government majority of IPPs agreed to lock the dollar rate at Rs 150 but the nine Chinese IPPs refused to do so. They insisted the Government must pay them rate of return on market-based exchange rate which is gone up by almost 30 to 40 percent in last two years. “Depreciation of exchange rate by 30 to 50 percent along with 15 percent guaranteed return on investment is a jackpot for any foreign or local investor and a nightmare for those who is paying it,” said a senior economist. He said these Chinese IPPs making massively high profits because they know that the Government neither complain nor cancel the agreements because of the debt obligations with their country.

The share of Chinese loans in Pakistan external debt of over $100 billion, now reached around 30 percent. It somehow validated the apprehensions sparked vociferous debates in Western media in which analysts sought to portray BRI as a “debt-trap” that, according to them, ensnares developing nations in unsustainable debts through “predatory lending” and allows China undue influence over their policies. The term “debt trap diplomacy” was first coined by Western policymakers in 2017 to describe the Chinese takeover of Sri Lanka’s Hambantota port on a 99-year lease after the island nation failed to honour its debt commitments. Since then, the term has been unscrupulously applied to all BRI projects, including CPEC.

Although the CPEC progress has slowed down in the wake of a debilitating economic crisis since 2018, still this gigantic project has yielded a number of road and energy projects. “Multiple highway construction programmes are progressing on schedule. Power plants that have entered commercial operation provide nearly one-third of Pakistan’s national electricity demand, having changed the situation of power shortage in Pakistan,” China’s National Development and Reform Commission (NDRC) said in a CPEC update on May 17, 2023. “The Gwadar port, co-built by China and Pakistan, has made great progress in creating a regional logistics hub and industrial base. In addition, the construction of the first phase of the Rashakai Special Economic Zone in Pakistan has been completed and achieved positive results in business attraction,” the NDRC further stated. This unprecedented economic activity created 236,000 jobs, 155,000 of them for Pakistani workers.

Nevertheless, Western analysts say that while Beijing and Islamabad have ardently sought to control the narrative on CPEC, details of the colossal project, including the terms of the investments and loans, the full extent of the projects, and the overall cost to Pakistan, remain murky. The US Department of State has also spoken out in recent months against what it sees as “China’s predatory lending to Pakistan” for possible geostrategic objectives. It argues that CPEC’s terms benefit Chinese companies and workers, and are unsustainable for Pakistan, leading to its rising debt burden.

Non-interference in internal affairs of other sovereign states is one of the cardinal principles of China’s foreign policy. This is the reason Beijing has thus far refrained from meddling in Pakistan’s internal politics, creating social pressure groups, or influencing its economic policies despite being its single largest lender. On the contrary, the Western multilateral financial institutions, especially the International Monetary Fund and World Bank, have repeatedly sought to dictate Islamabad’s fiscal policies. Similarly, the Paris Club creditors, especially the United States, France, Germany and Japan to whom Pakistan owes $8.5 billion, have also frequently used their influence for geopolitical and geostrategic purposes.

Having said that, Pakistan’s ruling elite has to ensure political stability and continuity of policies, improve security, and introduce broad-based economic reforms in order to reap full benefits of CPEC, which aims to transform Pakistan into a prosperous regional trade hub.