Mohsin Siddiqui (Chief Reporter)

ISLAMABAD: The 60-point action plan, spanning two years, has already received mutual endorsement from both the IMF and Pakistan. However, the federal cabinet’s approval is still required.

The Ministry of Planning provided a briefing to the IMF regarding the action plan and the progress made thus far. Sources indicate that the cabinet is expected to approve the plan by the end of December.

Negotiators also informed the global lender about their plans to separate tax policy from the functions of the Federal Board of Revenue (FBR), a move that was initiated under the Special Investment Facilitation Council (SIFC).

During the seventh day of discussions, the IMF assessed the government’s commitment to implementing the new action plan, particularly in the context of the Public Investment Management Assessment and Administrative Reforms of the tax system.

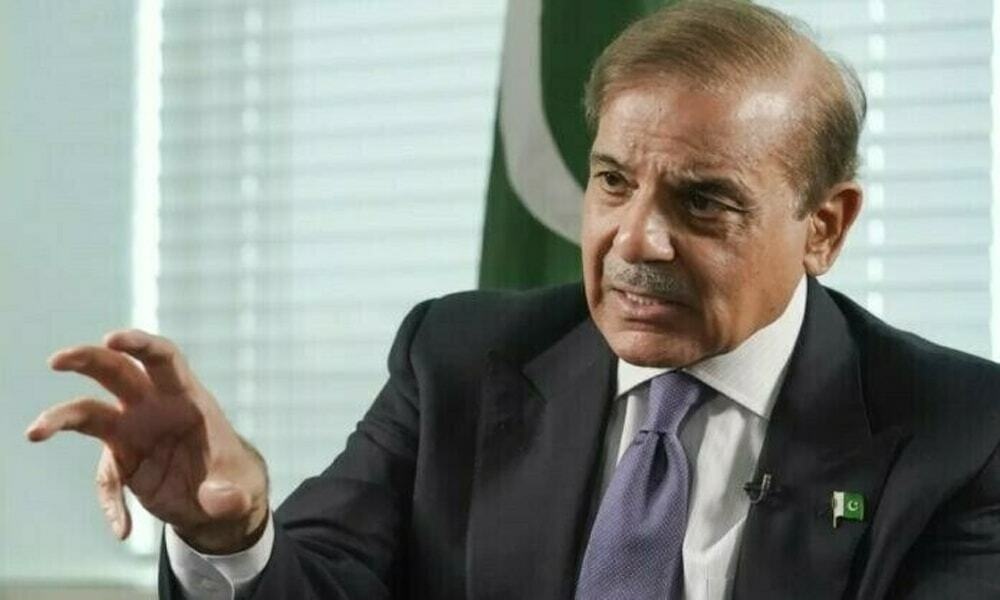

In a departure from past practices, interim Finance Minister Dr. Shamshad Akhtar attended these meetings, unlike the usual policy-level talks that commence on Mondays.

Pakistan has agreed to enact significant changes in its public investment policy, approval process, and implementation framework to curb wastage, which is often the result of politically driven projects, donor-designed schemes, and a lack of capacity and funding for their execution.

According to a technical assistance report prepared by the IMF following its visit in March, the current Public Sector Development Programme (PSDP) is financially unsustainable, with approved projects expected to take over a decade and a half to complete, not accounting for cost increases.

This year’s technical mission report has pinpointed weaknesses in Pakistan’s public investment management and has suggested measures to strengthen it.

Despite severe fiscal constraints and a substantial backlog of incomplete projects, the report revealed that the government added new projects with a total cost of Rs2.3 trillion to the 2022-23 budget.

Pakistan is committed to formalizing processes for obtaining information on projects funded from sources other than the PSDP, and expanding the PSDP with deadlines set from December 2023 to June 2024 to achieve these objectives.

A new mechanism will be established to report on risks associated with state-owned enterprises’ (SOEs) projects, including their contingent liabilities.

The IMF has noted a lack of coordination with provinces on investment. The National Economic Council’s effectiveness is limited to federally funded PSDP projects. In contrast, SOEs and other federal government entities funding infrastructure projects from their own revenues enjoy significant autonomy, potentially leading to a lack of coordination in investment plans, as highlighted in the technical mission report.

The Public Finance Management Act requires all projects to receive technical approval before receiving funds in the budget. However, there are no established selection criteria to guide the allocation of limited budget resources for PSDP projects.

Notably, one of the largest components of the PSDP, parliamentarians’ schemes, does not follow the regular approval process; approvals are instead discretionary in nature.

Pakistan has committed to the IMF to develop a draft internal proposal for selecting projects funded out of the PSDP by the end of December. Final criteria for selecting federal funding projects will be published by mid-2024, as outlined in the action plan.

Similarly, in the first half of the next year, Pakistan will conduct a review of technically approved projects, potentially leading to the removal of hundreds of schemes from the high-priority list.

The IMF report has highlighted numerous loopholes in implementation and monitoring systems, recommending improvements in ex-post evaluation and more active portfolio oversight.

While some mechanisms are in place to ensure alignment between strategic plans, national goals, and investment projects, the national planning process experienced interruptions with the failure to finalize the 2018 National Plan. Additionally, sector-specific plans provide strong guidance only in certain sectors.

The interim finance minister shared with the IMF her plans to restructure the FBR, indicating that a task force is actively working on structural changes to the taxation system. She also mentioned the potential separation of the policy function from the FBR.