Mohsin Siddiqui (Chief Reporter)

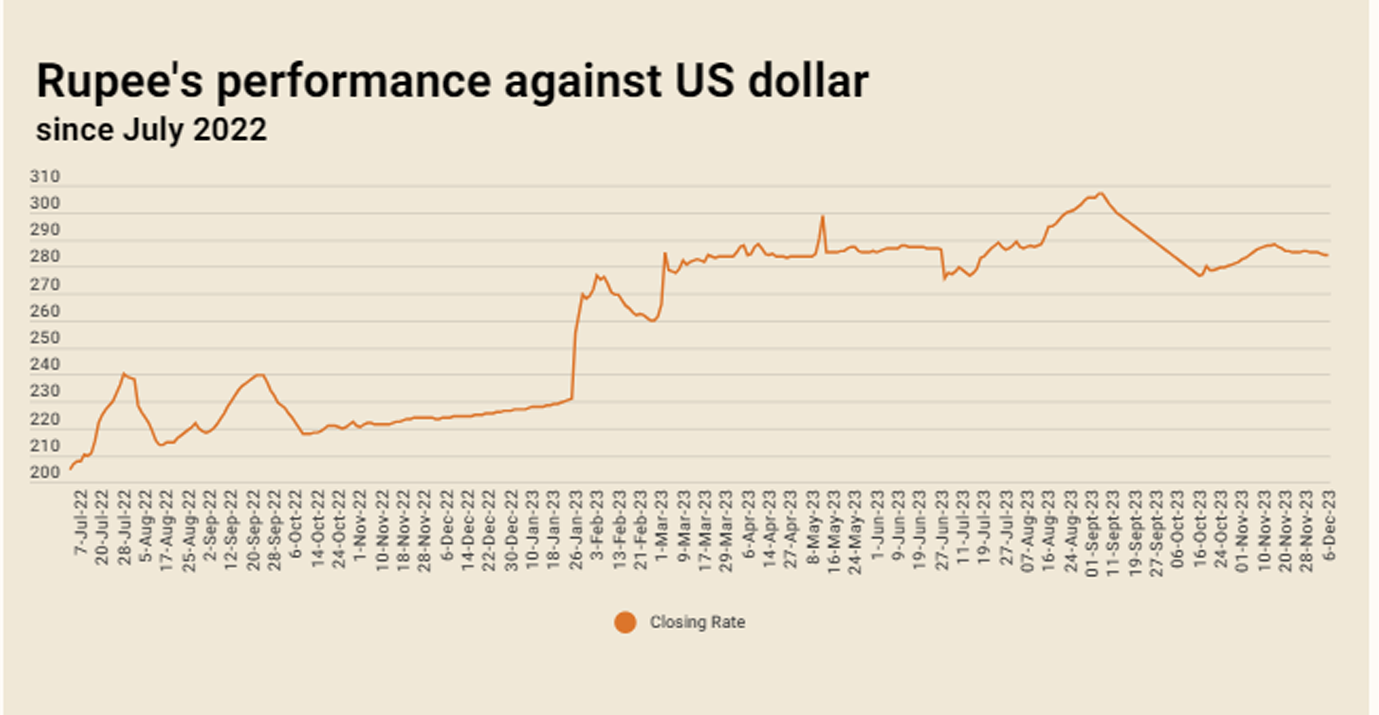

Pakistani rupee has extended its gains against the US dollar for the seventh consecutive session, appreciating by 0.08% in the inter-bank market on Wednesday, according to the State Bank of Pakistan (SBP). The rupee settled at 284.14, marking an increase of Re0.24 from the previous session where it registered a marginal gain to settle at 284.38 against the US dollar.

In tandem with the currency news, the SBP reported a significant development related to the federal government’s total debt (domestic and external). During the first four months of Fiscal Year 2024, the total debt stocks increased by Rs1.641 trillion, reflecting a 2.7% rise from July to October. Cumulatively, the federal government’s total debt stocks reached Rs62.482 trillion by October 2023, compared to Rs60.841 trillion by June 2023.

Globally, the US dollar showed strength against a basket of currencies, nearing a two-week high on Wednesday. Investors analyzed US economic data indicating a cooling labor market, fueling speculation of potential Federal Reserve rate cuts in the coming year.

The dollar index, measuring the US currency against six rivals, edged 0.019% higher at 103.99. This month, the index is up by 0.5%, rebounding from its steepest monthly decline in a year in November.

Market observers paid attention to data revealing a decrease in US job openings to a more than 2-1/2-year low in October, signaling the impact of higher interest rates on demand for workers. Additionally, the ratio of job vacancies to unemployed persons in October hit its lowest since August 2021.

The focus now turns to the release of the November jobs report on Friday, providing insights into the economy’s strength ahead of the Federal Reserve’s policy meeting next week.

As a key indicator of currency parity, oil prices slightly rose in Asian trade on Wednesday after four consecutive sessions of losses. Investors assessed the effectiveness of an extension in OPEC+ cuts on tightening supplies against concerns of a worsening demand outlook in China.

Brent crude futures climbed 17 cents to $77.37 a barrel, while US WTI crude futures rose by 6 cents to $72.38 a barrel.