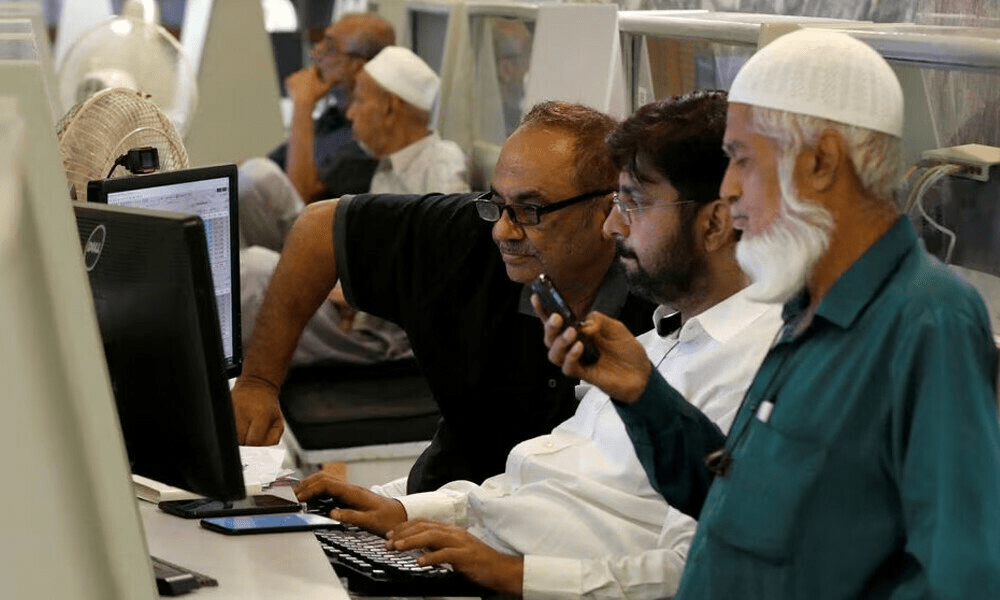

KSE-100 index witnessed a substantial surge, propelled primarily by robust performances in the pharmaceutical and energy sectors. By 11:00am, the index reached 61,037.74, marking a noteworthy increase of 578.00 points or 0.96%.

Notable stocks such as OGDCL, PPL, and SEARL were observed to be trading positively, contributing to the overall market optimism.

Mohammed Sohail, CEO of Topline Securities, highlighted the rally in pharmaceutical stocks, attributing it to the government’s recent decision to deregulate non-essential products. This move, initiated through a government notification, was aimed at rectifying distortions in pricing caused by DRAP, coupled with rent-seeking practices by its employees.

Meanwhile, speculation looms in the federal capital regarding the appointment of Pakistan’s next finance minister, a pivotal role that could significantly impact the country’s political landscape. Sources suggest that the decision is likely to involve consultation with influential entities, particularly the establishment, which holds considerable sway through its representation in the apex committee of the Special Investment Facilitation Council.

In a related development, Fitch Ratings expressed concerns about Pakistan’s near-term political uncertainty following the closely contested election outcome. This uncertainty, as per Fitch, could complicate the nation’s efforts to secure a new financing agreement with the International Monetary Fund (IMF).

On the previous trading day, the PSX experienced a notable turnaround, witnessing a nearly 1% increase in the benchmark KSE-100 Index, settling at 60,459.75, and up by 586.79 points.

Globally, Asian markets remained subdued, with Asian shares struggling to maintain momentum despite a larger-than-expected interest rate cut in China. MSCI’s broadest index of Asia-Pacific shares outside Japan slipped 0.1%, retracting from its recent highs. South Korean shares, in particular, experienced a 1% decline.

As trading resumed following a US holiday, US Treasury yields edged up, while S&P 500 futures indicated a slight decrease. Despite the rate cut in China, global markets outside the country displayed caution, particularly in light of reduced expectations for US rate cuts following elevated readings on producer and consumer prices.