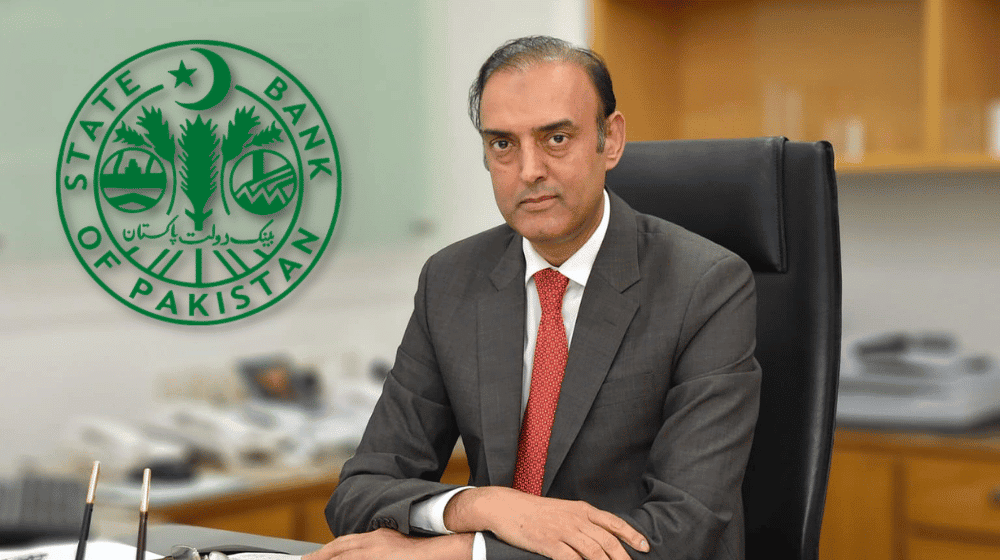

State Bank of Pakistan (SBP) Governor Jameel Ahmad launched the SBP’s strategic plan, SBP Vision 2028, for the 2023-2028 period in a ceremony attended by the bank’s senior management.

The SBP Vision 2028, the first plan post-amendments to the SBP Act, outlines the central bank’s vision, mission, and key goals for the next five years. Developed through a consultative process, it reflects the commitment to foster price and financial stability, contributing to sustainable economic development.

Governor SBP emphasized that the plan addresses evolving risks and challenges, including climate change, digital innovations, disruptions, and cybersecurity threats. SBP Vision 2028 revolves around six strategic goals, such as maintaining inflation, enhancing financial system efficiency, promoting inclusive financial services, transforming into a Shariah-compliant banking system, building a digital financial services ecosystem, and becoming a high-tech, people-centric organization.

The strategic goals cover five cross-cutting themes: strategic communication, climate change, technological innovation, diversity and inclusion, and productivity and competitiveness. The plan envisions SBP as a people-centric institution prioritizing the well-being of Pakistanis, with a primary focus on achieving and maintaining price stability.

Governor Ahmad highlighted that SBP Vision 2028 aligns with the Shariat Court decision, aiming to transform the conventional banking system into a Shariah-compliant one. The plan outlines steps for this transformation, addressing challenges like converting government debt, simplifying Shariah-compliant financing products, and industry training.

The SBP collaborates with industry, Shariah scholars, and the federal government to address these challenges, as stated in the SBP Vision 2028. The plan considers political, economic, social, technological, environmental, and legal factors to ensure a responsive and forward-looking strategic direction for the central bank.