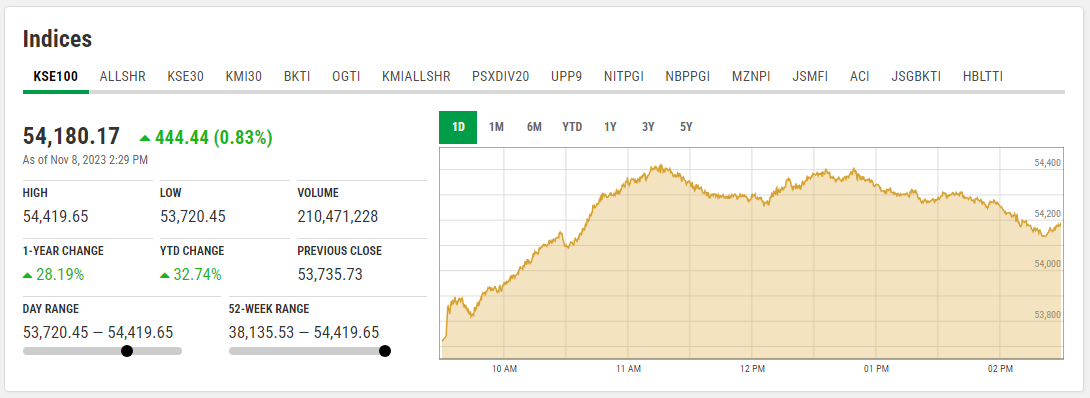

In a remarkable morning trade session on Wednesday, the Pakistan Stock Exchange’s benchmark KSE-100 index made a robust move into positive territory, confidently crossing the 54,000 threshold. At 11:30 am, the index soared by 615.22 points, representing a substantial 1.14% increase from the previous day’s closing value of 53,735.73, ultimately settling at 54,350.95.

Mohammed Sohail, the Chief Executive of Topline Securities, was quick to highlight the index’s impressive performance, noting, “KSE-100 index reached a new high of 54,400 during today’s trading session.” This positive surge was primarily driven by mounting optimism among traders and investors, as there is growing anticipation that interest rates could potentially decrease sooner than initially expected. This optimistic outlook stems from a recent drop in global oil prices, which could potentially alleviate inflation pressures within Pakistan’s economy.

Meanwhile, Faran Rizvi, the Head of Equity at JS Global, shared his perspective on the current market dynamics. He pointed out that the market had ventured into “uncharted territory” and that it was technically showing signs of being overbought, suggesting a possible need for a temporary pause at the present levels. However, he also emphasized that stock valuations remained significantly low, and investors were actively exploring untapped opportunities that were yet to fully materialize.

Rizvi explained, “Stock valuations have dwindled to just one-third of the index’s peak, which was observed back in May 2017.” To illustrate, the price-to-earnings multiple, a key measure of a company’s share value relative to its per-share earnings, was at 12 in May 2017 when the index stood at approximately 52,800 points. Currently, this multiple has dwindled to a mere four, despite the index hovering around the impressive 54,500-point mark.

The Pakistan Stock Exchange’s KSE-100 index displayed strong performance, reaching new heights in early morning trading. The positive sentiment is driven by the prospect of reduced interest rates following a decline in global oil prices, even as market experts caution about the need for prudence in the face of overbought conditions and potential market pauses.